Welcome! If you are here, you may be looking for a Tallahassee buyers agent and be ready to buy your own home. Congratulations! A professional buyers agent can help you negotiate the best home for your family. Also, real estate is still a solid way to build personal wealth.

The process of buying a home in Tallahassee can be overwhelming and cause sleepless nights. We have been there and remember the anxiety well. Buying does not have to be a nightmare. Educated buyers make educated decisions without sinking into that anxiety (as much anyway!). We believe in helping buyers find all the answers they need to feel comfortable with the process. For us, it is always people over property. Below you will find some general information on the process of buying a home in Tallahassee and Florida. In the following pages we discuss financing, house tours, inspections, common mistakes, and how to win multiple offers.

Let’s start with a question I hear a lot. (Spoiler alert: Tallahassee buyers agents are paid what the listing agent negotiates with the seller prior to listing in the MLS.)

How do Tallahassee buyers agents get paid?

The Process of Buying a Home

The process involves a lot of moving parts and players that must communicate well with each other, and unfortunately, those who prey on ignorance. It is important for you to be able to have someone to help you sort it all out.

1. Meet with and choose a full-time Tallahassee Realtor as your Buyers Agent.

You are about to make your biggest transaction ever, and knowing your agent has your back will help you buy with peace of mind. When you are ready, meet with a couple agents and choose one to represent you. We know many wonderful people who work in real estate part-time. Even my broker started out as a part-time Tallahassee real estate agent. However, it can be frustrating to wait for that agent to have a break at work so they can answer a question. (Why this matters – Being the data nerd that I am, I have read the research on real estate agent effectiveness. Experience matters. I’m happy to share references or articles.)

Your Tallahassee Realtor should be someone who has experience to help you meet your family’s goals. Real estate agents receive continuing education for our industry. This includes information on programs available for first time home buyers.

It can be awkward calling a stranger and scheduling a meeting. We remember, we were in those shoes before…we really do want to hear from you! We ended up going with the first agent we talked to, and that was not a good fit. Of course we didn’t know it until it was too late and we were already under contract. The help we received from our Tallahassee buyers agent was underwhelming. Here are questions to ask your Tallahassee buyers agent when you meet your agent to help you avoid the mistakes we made.

Meeting Tallahassee Buyers Agents

Once you start looking for a home, you will be bombarded with ads on Facebook and Google from different brokerages. Your friends and family will have people to recommend. Here are some other ways to meet local buyers agents:

- Visit open houses. It is rare that we are not hired by at least one visitor to an open house we are hosting. It’s a great way to get to know an agent and how they handle tough questions.

- Watch for nametags. We have met multiple customers in grocery stores and home improvement stores when we forgot to remove badges.

- Read websites. Granted, most Tallahassee Realtors are not also writers and are still awesome people. However reading their thoughts gives you an understanding of who they are and how they will help you.

- Ask for recommendations on Facebook. Bless your heart if you subject yourself to this… It would be better for your DMs and your sanity if you search for the “#serviceSunday” posts.

- Read reviews. Many agents will remove bad reviews. That’s why this one is last on the list. Did we mention that we once had an awesome buyers agent review from a buyer we were not even working with? They had made an offer on our listing and then their Tallahassee buyers agent left the country!

Sometimes they sound too good to be true. You wonder if they are legitimate. If you are still not sure after you have had a conversation with them, you have your answer. Do not be afraid to ask for references! We have many former customers that will sing our praises.

A final note about selecting a Tallahassee Buyers Agent

Your agent can help you find knowledgeable and local lenders. Knowing your rights can protect you through this process. No one can refuse to sell to you or work with you based on your membership in a protected class. Read more here. Lenders cannot hide fees and must disclose important information in a timely manner. (Excellent information about money here.).

2) Figure out how much you can comfortably afford.

Many of us do not live by a budget. If this includes you, it is a good time to set one up. The limit of what you will qualify for will be based on your income and your debt to income ratio. Remember, your income is dependent on you can verify monthly. Here are three ways you can tell how much you may be able to afford in a Tallahassee home.

- Your monthly housing payment should be less than half your monthly income.

- A general rule of thumb is that you can afford around 2.5 times your yearly income.

If a family member is going to ‘gift’ you a down payment there are hoops to jump through. You will provide the lender with copies of your bank statements. If there are large deposits, your lender will need to ‘source’ those funds. That means, that the lender will ask the ‘gifter’ to provide bank statements and proof that the money is not a loan. If you are receiving a money gift, talk to your lender. They will help you document what needs to be documented. If a friend is going to give you money, there are a lot more obstacles and ‘sourcing’ concerns. It can be a nightmare.

New Construction

If you are building, your Tallahassee buyers agent can help you negotiate the builder’s contract and the construction process. If you are looking to build a home on a site you own or will buy, you will need a construction bridge loan. In that case, you may have to pay the interest while your home is being built.

Not all lenders are able to fund construction loans for site built homes. Any lender can help you with a new home already built by the builder. This can mean a spec home or a tract home in an established subdivision. Many new homes are available that qualify for FHA or VA financing. The downside is that there are few personalized touches you can add to the construction of the home.

Some Mortgage Related Rules To Keep In Mind:

- Keep side hustle deposits in a separate account. Creates fewer headaches for the underwriter.

- Do not open any new accounts or CLOSE any old ones without talking to a lender first. Closing old accounts can increase your debt to income ratios.

- Do pay down the debt you can and keep an eye on your credit score.

- We have worked with buyers that have attempted to hide debts in former names or mortgages with ex-husbands. It has been buyers being misleading statements on loan applications that have led to the only binder deposits we have ever lost on the buyer’s side.

- Read about getting preapproved, finding a lender, and choosing your mortgage here.

- Here are some other things to consider before touring homes.

3) Shop for a mortgage.

Talk to at least 2-3 LOCAL mortgage brokers before making a choice. Those bank overlays (or local rules) can make a big difference in whether you qualify for a mortgage or not. There are federal rules against lending to those working in the cannabis industry. We have local lenders that can help.

Some lenders cannot just drop rates or agree to lender credits just because you ask. However, if you come back with documentation from another lender, they will generally try to match them. Buying a home is a huge financial investment. Talk to a couple lenders (not too many – it gets very confusing quickly). Read more about first time home loans and lending options on our buyer financing page.

Choose Local!!

We have had sellers reject higher offers because it was an unknown lender. This may seem silly to some. However, local people prefer doing business with local people. There is a higher level of comfort knowing you can walk into a local office and get an answer for both Tallahassee buyers and sellers.

Make sure you choose an EXPERIENCED and LOCAL lender. We have a couple areas with quirky requirements and there are some places that will not qualify for ‘typical’ loans because of federal lending requirements. If your lender is not aware of these they may not be experienced enough to help you protect your investment. Check out our page here for more information about mortgages (Financing 101).

4) Shop for a home.

Do not plan to shop for months and see dozens of homes. It leads to heartbreak.

When you meet with your realtor and develop your plan, you will establish your timeline. and wants/needs for your new home. If done properly, you should not be searching for homes for months or touring dozens of homes. This is a strong seller’s market and the buyer who sleeps on their decision may very well not sleep in the house at all. Most buyers see 6-8 homes. If you are still shopping months later, you agent has failed to uncover an important detail during the interview process.

Here are some other things to consider when you are touring homes.

Geek alert!! Studies have shown that the more homes you see, the more likely you are to be dissatisfied with your final decision. (Google “jam study.”) If you just like to tour homes and see different layouts and features (I mean, who doesn’t?), check out open houses or consider getting your real estate license.

5) Make an offer through your Tallahassee buyers agent.

Here is where your Tallahassee buyers agent experience will benefit you the most. Your agent has spent time with you, and they know what is most important to you and your family. Because of this, they will help you negotiate the best terms and conditions of your purchase. For this reason, do not approach the listing agent to write your offer. They work for the sellers.

Why is it so important to qualify for a mortgage before you make an offer? Your financing type is on the first page of the offer contract. Because of this, the financing becomes an important part of the negotiating process. It can also be the reason you lose to another buyer. Experienced Tallahassee buyers agents know what lenders are looking for and can help you negotiate those terms.

Some agents scoff at having buyers write letters to the sellers. They feel it is a waste of time. Some agents will not accept them for Fair Housing reasons. We have found that home buyers and sellers are often curious about each other. They will google the other party just to see what they find. We have had more than one listing agent, in 2022, tell us that the letter from the home buyers positively influenced the sellers’ decision-making. Maybe the scoffing Tallahassee buyers agents are not good at writing. We have found them worth the time and effort.

Check out more information on our buyer negotiations page.

6) Get inspections – Do NOT waive this contingency.

This is so important. Do not skimp here. Be prepared to walk away if you have a negative inspections. Many buyers want the sellers to reimburse them for the inspections. This is especially true when the Tallahassee buyers feel that the sellers were not being truthful. When you sign the contract, you acknowledge that the inspections are a buyer’s expense. They can be expensive, but closing on a home with a major defect will cost you more. Also the contract requires you to provide those inspections to the seller if you terminate the contract.

On a final note: There is no guarantee that the inspector can catch every hidden defect, but big issues generally leave clues. Some inspectors have more expertise than others, and charge accordingly. Also, this contingency period is for more than just inspections. If you find out that your monthly payment will be too high to be comfortable, or that rush hour traffic from the neighborhood is ridiculous, you can cancel the contract. For more information, check out our buyers inspections page.

If you decide to walk away during your contingency/inspection period, most contracts allow the buyer to receive their down payment back. Once the title agent has received the termination (signed by both parties), they will release the money immediately.

7) Choose homeowners insurance – Let your agent know your closing date and find out if they need an inspection of their own.

A homeowners policy covering the mortgage company is required at closing. Make sure that you are also covered in the event of a loss. If you work with an experienced agent, they will know which reports you will need and what questions you are going to be asked. Once you pick your policy, your realtor can make sure the insurance agent has all the information they need. There is nothing worse than the insurance inspectors report three months after you move in requiring you to replace the hot water heater or roof.

This is another item that can be shopped around to save you some money. Again, we caution that cheaper is not always better. Read over what is covered and not covered. If there are any outbuildings, decide if you want them covered from loss. If you have valuables, make sure the agent knows about them. Also, make sure that you are made complete after a loss – not just the mortgage company. These are all “Conversations” to have with your insurance agent.

8) Closing for the Home Buyer – O Happy Day!!

Although the home buyer does not always see or hear about it (unless there is an issue) there is a lot that happens between inspections and closing. Most are automatic and all are meant to get us to the closing table. The lender will have you pay for and order the appraisal (usually just after you negotiate a contract, depending on contract terms). When working with us, we will ask the lender to order (for contract compliance) but pause the appraisal until after we have inspections. If the timeline is short, and we may order the appraisal early with the buyer’s understanding that they may end up purchasing an inspection AND an appraisal on a house they will not own. That stinks so we try not to let that happen.

Title insurance requires a survey. You are welcome to shop the price around the local surveyors. Sometimes the title company will accept the previous survey for title insurance purposes. If the seller has it available and has not made any changes, they can sign an affidavit at closing. The affidavit states that the seller has made NO CHANGES to fences or the property. If available, it will save the buyer a couple hundred dollars.

Do NOT forget to bring these items to closing

Please remember to bring a photo identification with you to closing. The closing agent will notarized several forms. Because of this, the closing agent will verify your identity. Often, we will ask you to send us a picture of that identification when writing the contract. There are fewer problems when the photo identification matches what is on the contract. If your name does not match, there will be an alias form in your closing packet.

Please remember closing costs must be paid with a cashier’s check or money order. They will not take personal checks. You can also wire transfer your money, but please do so carefully. We have had more than one home buyer disappointed when they wired money to the wrong account and it was gone forever. Tallahassee real estate agents and closing agents are common targets for hackers. It is easy to hijack an email and send incorrect account information. The only way to know for sure is to call the title agent and ask her to verify the account numbers.

Married and buying a Tallahassee home for yourself?

In Florida, if you are married and buying a home, the spouse will be required to sign something. Even if the spouse will not be on the deed, they sign a form stating they know that they are not going to be on the deed. If one spouse will not be available for closing, the other spouse can sign for him/her. The lender will have a power of attorney drafted that allows this to work. Check with your lender for their rules. Just because you have closed on your house does not mean we stop being available to you. We are always here to help anytime.

How WE Work as Tallahassee Buyers Agents

Involve us as early in the process as you feel comfortable. Buying (or selling) a home is a HUGE investment of time, energy, and emotion and the more we can talk with you and get to know you the better we will be able to help you when the pressure is on. Read through what we have posted here and get a feel for how we work and call us when you are ready.

We hope this website helps you figure out what you need to do to become a Tallahassee home owner. People are overwhelmed by the sheer amount of information out there today. Knowledge is power, but when you are NOT the one buying or selling a home daily, it can be tough to know what information is important or relevant to Tallahassee real estate. We want to be the agents your trust to guide you through your next Tallahassee move. We have been there ourselves and have tools to help.

Who we are:

We are low-key and not pushy. This is because we see our job as helping your buy or sell your Tallahassee home. We will match our motivation with yours. And will get you to closing with the least amount of hassle. We are full-time Tallahassee real estate agents and making customers happy is our primary focus. We will keep you updated anytime we hear anything involving your transaction and will keep files on a shared drive you can access for up to 5 years after closing.

How we can help:

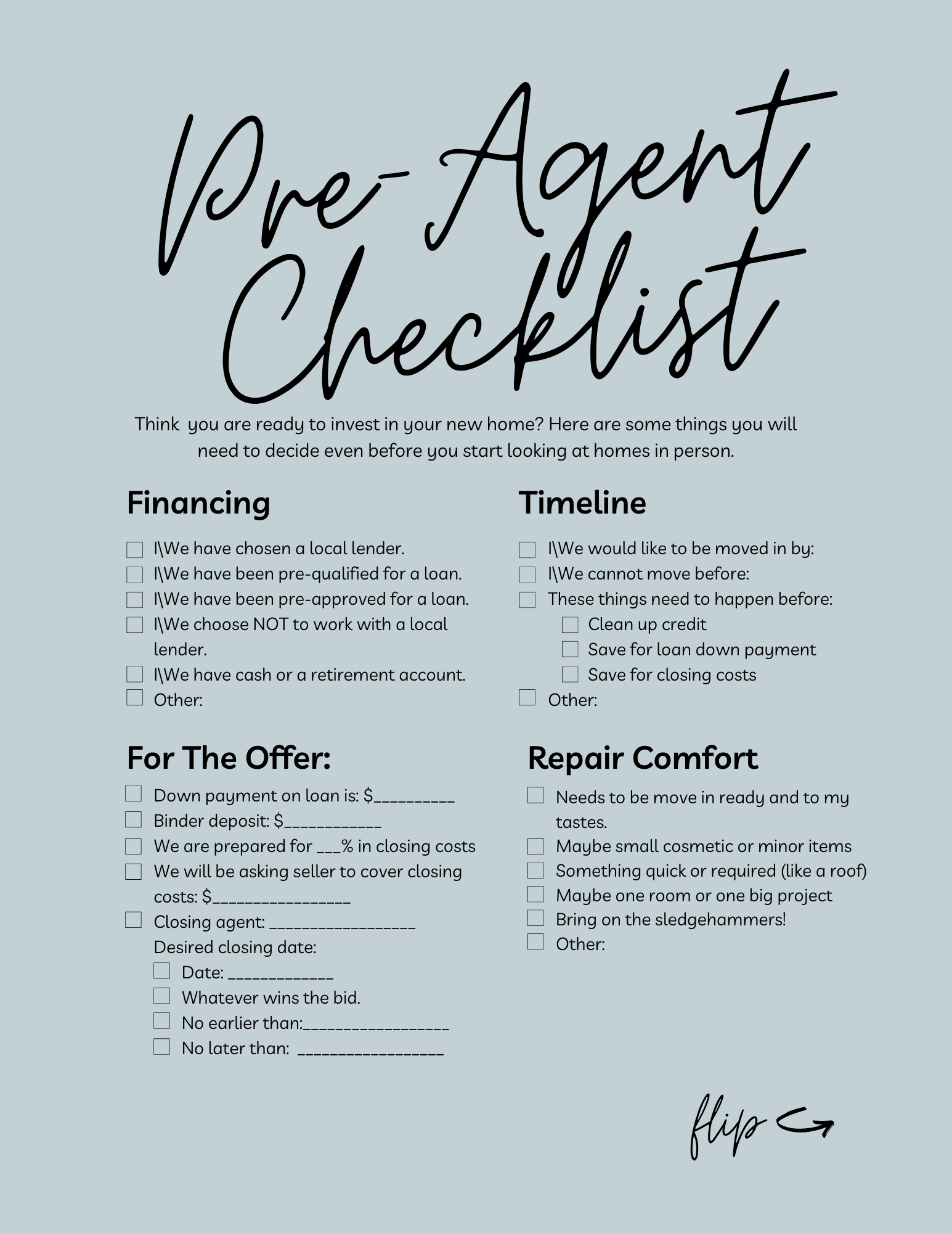

We offer several checklists and put timelines on a shared calendar. We also have a list of professionals that we have used before. They are independent and do not answer or serve us in any way. You can trust Tallahassee locals to provide you with excellent customer service and communication. We know we are patient, helpful, and knowledgeable, but do not just take our word for it. We are also happy to share a list of local people who have worked with us in the past. They would love to talk to you about their experience with us. There is also a lot of information on this site to guide you through the process.

Next steps:

When you are ready, contact us in the way you would like to be communicated with – whether it be calling, texting or IM through our social media accounts. This does not have to be the ONLY way we communicate with you. However, it will be the FIRST way we communicate with you, and you can change it anytime. If we are working with someone, our phones will be on vibrate. So If you call, please leave us a message.

When you reach out, we will do two things:

- Setup a time to talk to all the people involved in the process (spouse, parent, child, sibling or other). We can do this in a phone or video call or in person – your choice.

- Collect contact information and some basic information about your goals.

In this scheduled conference, we are going to ask a bunch of questions. Our goal is to discover how to achieve your goals. Because each person and family is unique, we like to talk to all the stakeholders at one time. We can even meet you during the evening or on the weekend. Years of experience has taught us that 30 minutes here saves hours & (lots of confusion) during the process of buying and/or selling a home.

Feel free to Contact Us at your convenience.

Not ready to buy?

Check out our other pages on the Tallahassee home buyers journey. Start on the Tallahassee home buyers page. We have some quick tips to get you ready to tour homes. We also have more information about financing and mortgage options. There are some things you should keep in mind when you are touring homes as a Tallahassee home buyer.

Many buyers are worried about being taken advantage of during negotiations. This is how to get what you want from negotiations from your Tallahassee buyers agent. Here’s what you should know about the contingency period after you have an accepted offer. You do not want to make these mistakes.

Send Me My Free Home Buying Book!

Give us your email address and we will send a shareable link for the home buying book. Contact us if you have any questions!

"*" indicates required fields