Negotiating a Home Has Recently Changed for Tallahassee Home Buyers

Tallahassee home buyer negotiations have drastically improved! This fall of 2022, Tallahassee home buyers are better positioned to negotiate the sale of their new homes than they have been in years. After the Tallahassee real estate market has been HOT for years, rising interest rates have dropped buyers out of the market! The cooling real estate market has helped put negotiating leverage back in the hands of Tallahassee home buyers.

Home buyer negotiations are about finding a win-win and a meeting of the minds. Even with a cooling market, many popular neighborhoods still see multiple offers on BEAUTIFUL and reasonably priced homes within days (and sometimes hours!)! Do not wait to submit an offer if you see a home you love. If you wait, you may lose the house to the buyer faster than you.

After successfully negotiating a contract for your new home, you will enter the contingency period of your contract. That is the time to get all the inspections and answers to your questions. You will find more information on our page about home inspections for Tallahassee buyers. Let’s talk about three ways Tallahassee home buyers prepare to negotiate their homes: Things to Do, Things to Know, and Things to Decide.

Things TO DO to Prepare for Home Buyer Negotiations

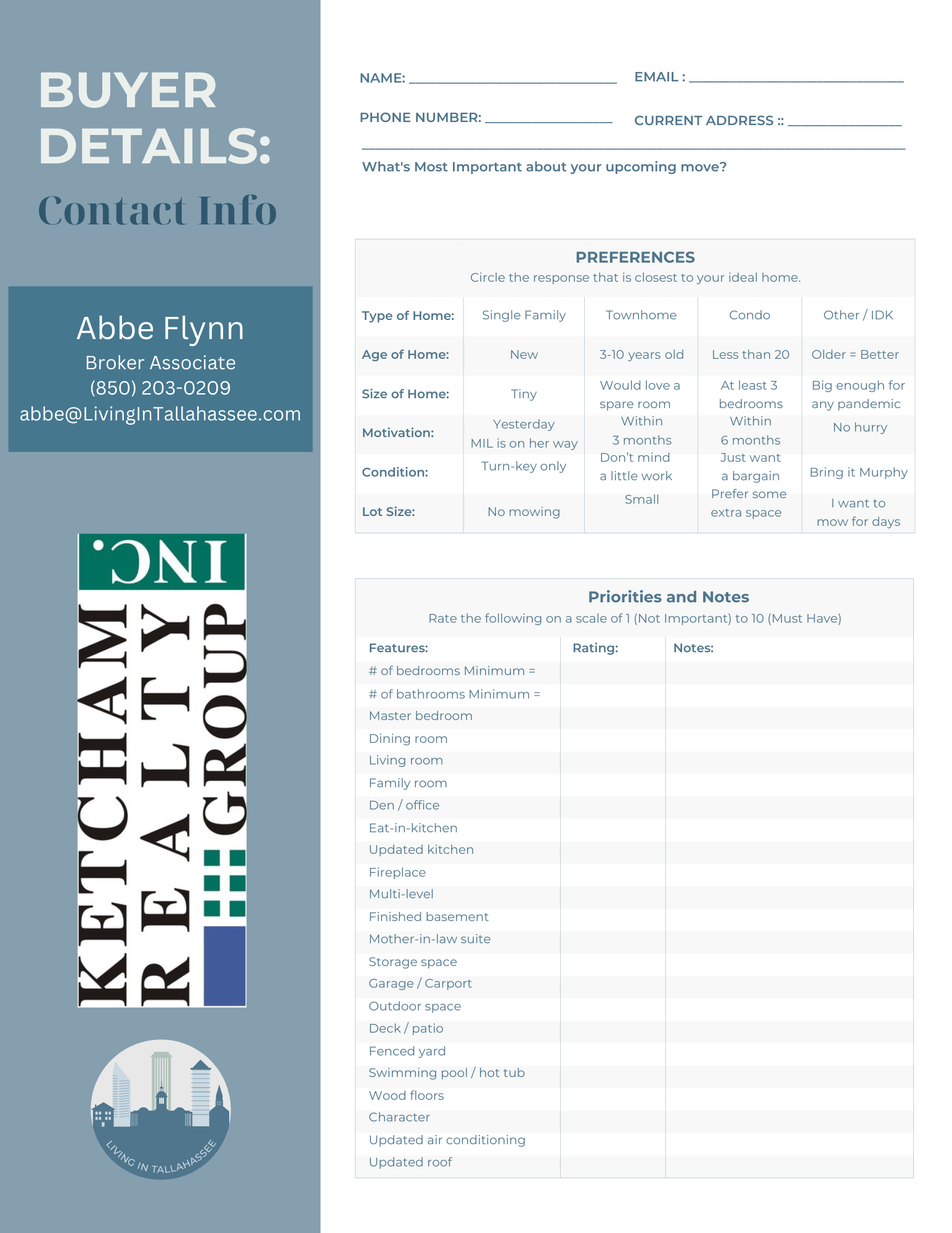

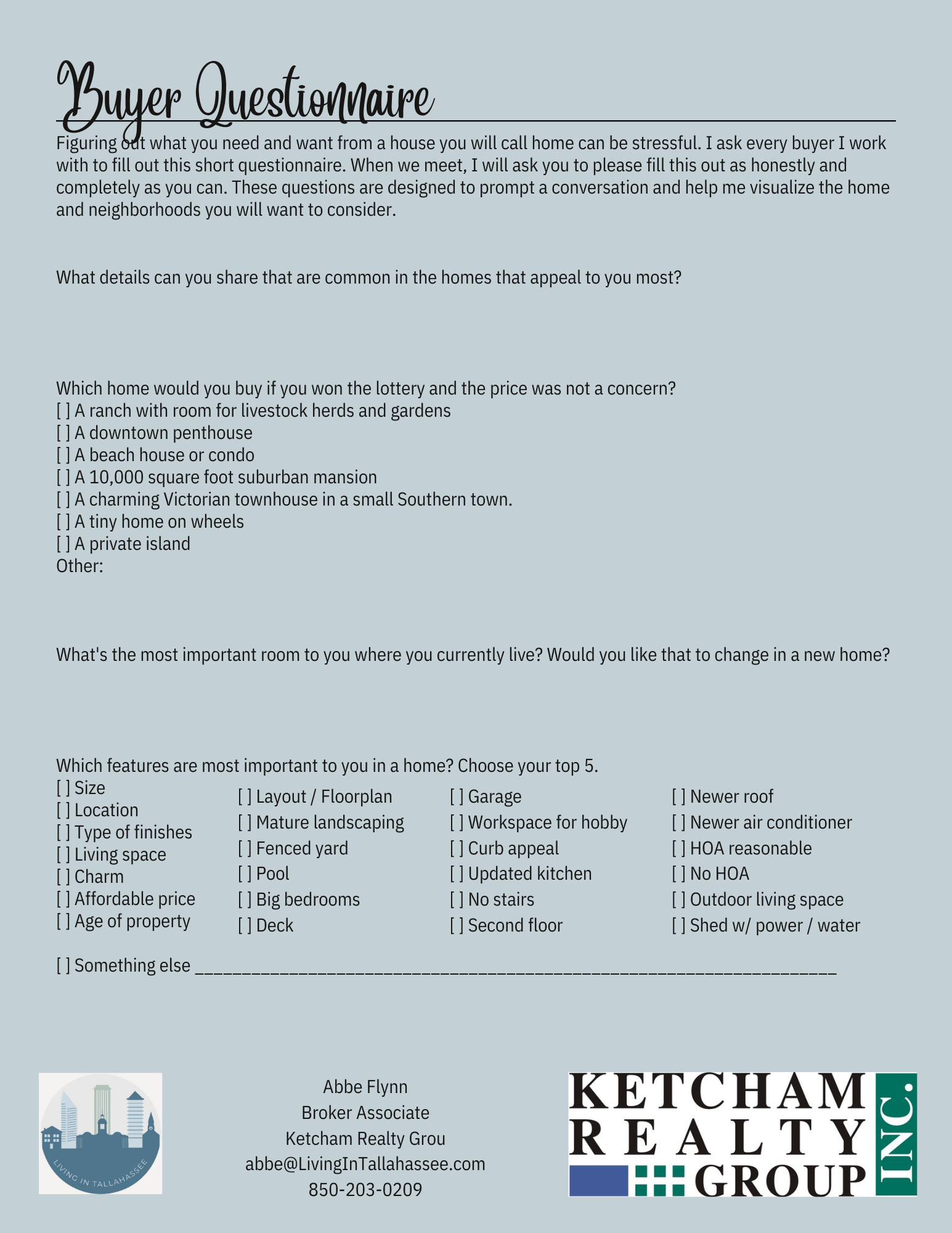

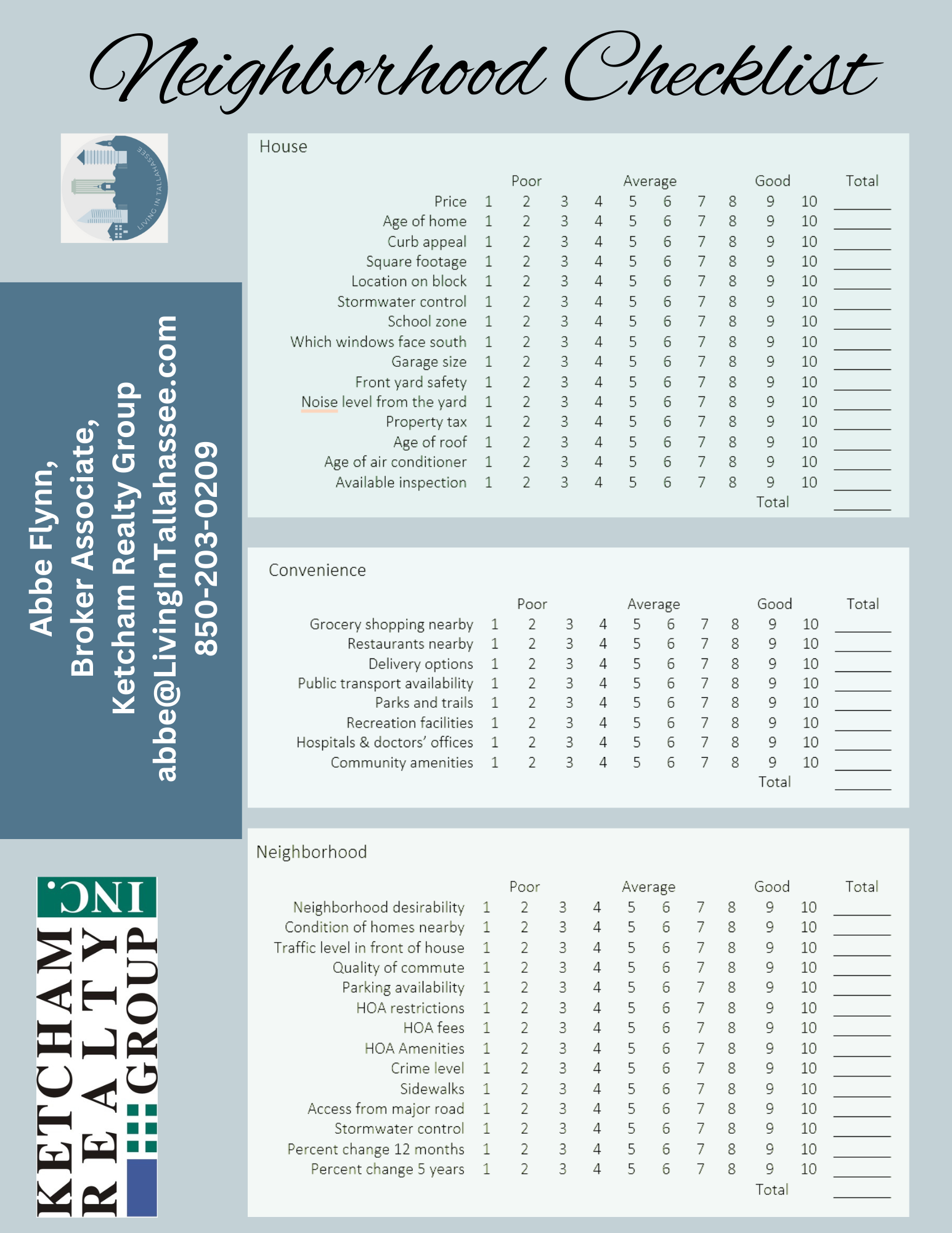

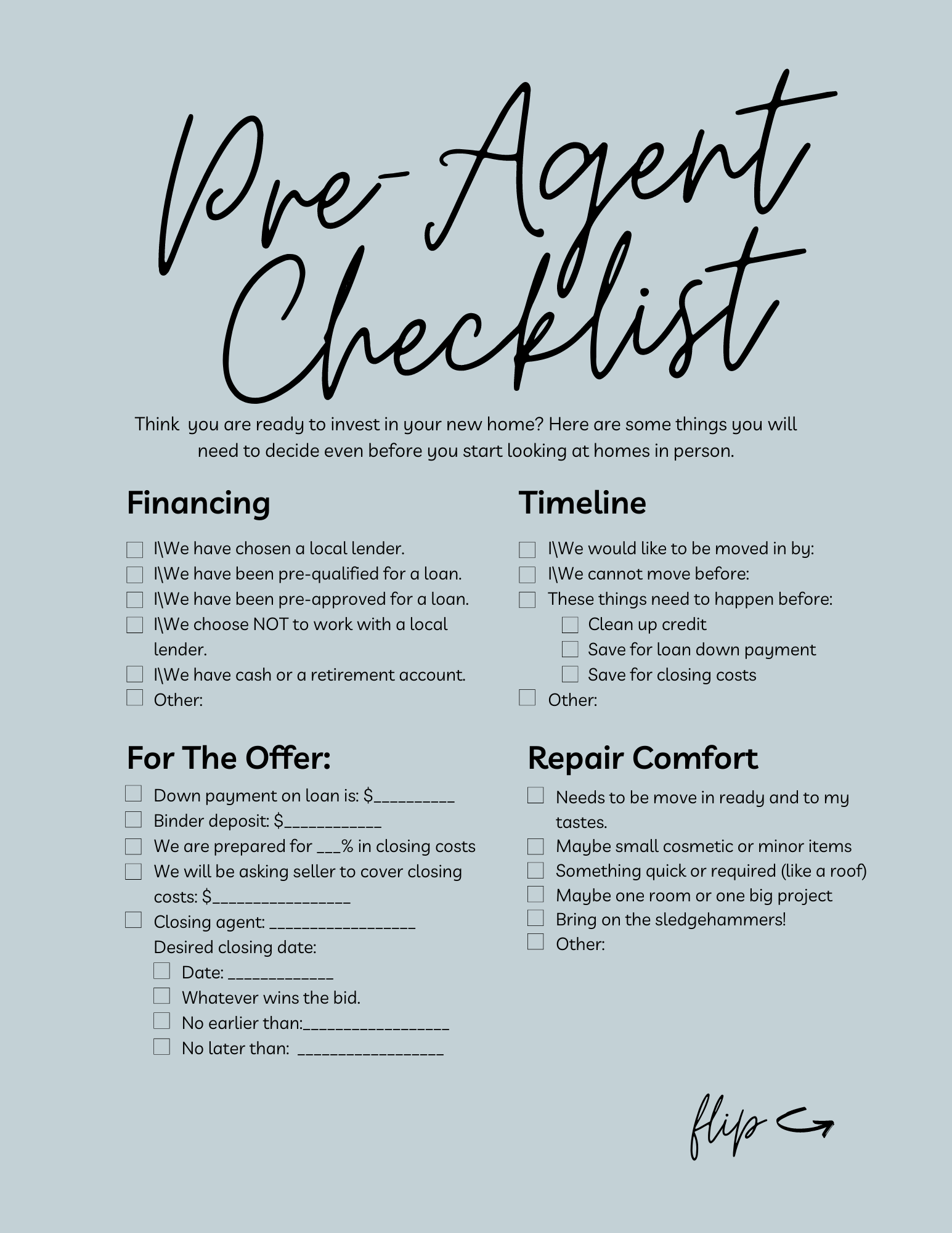

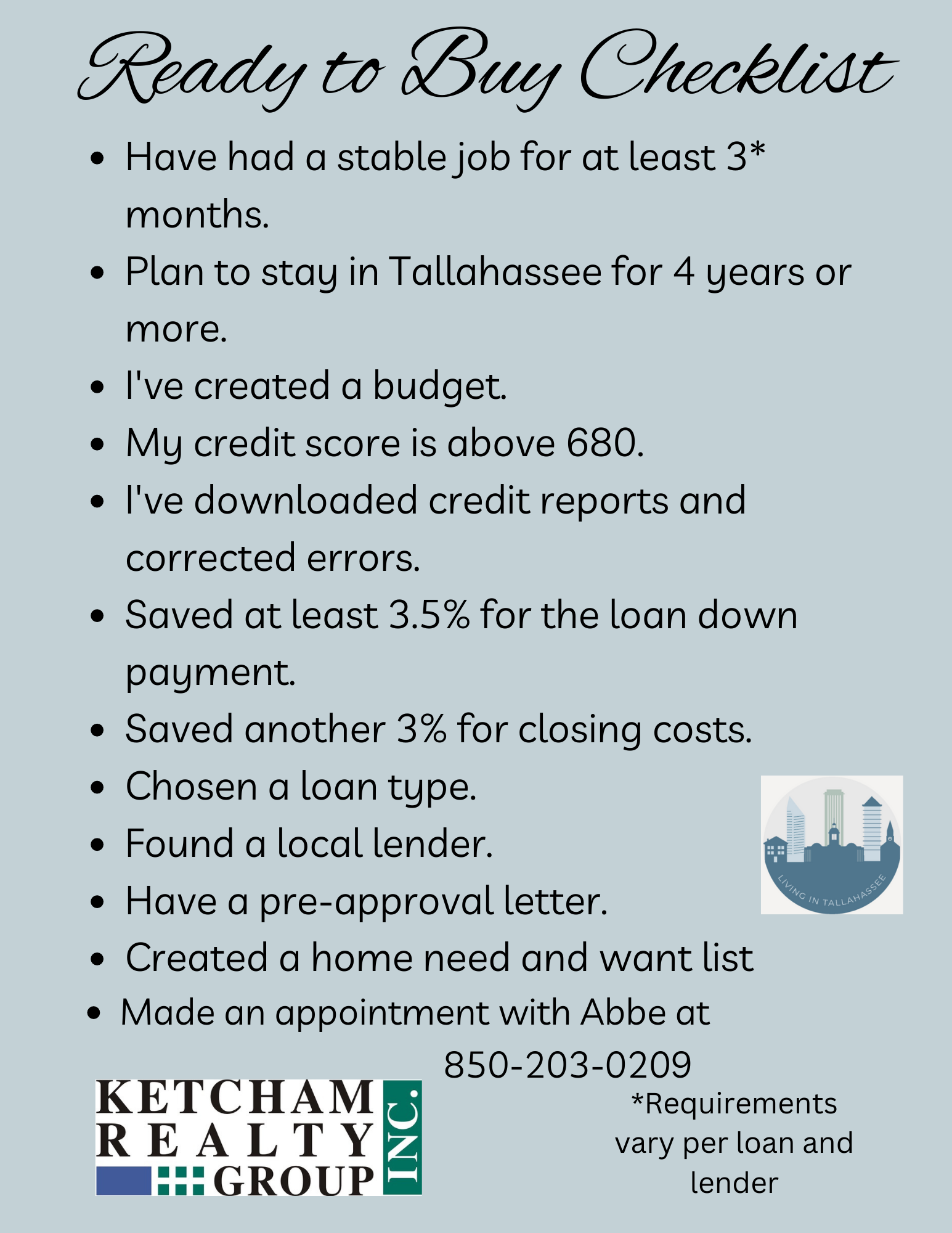

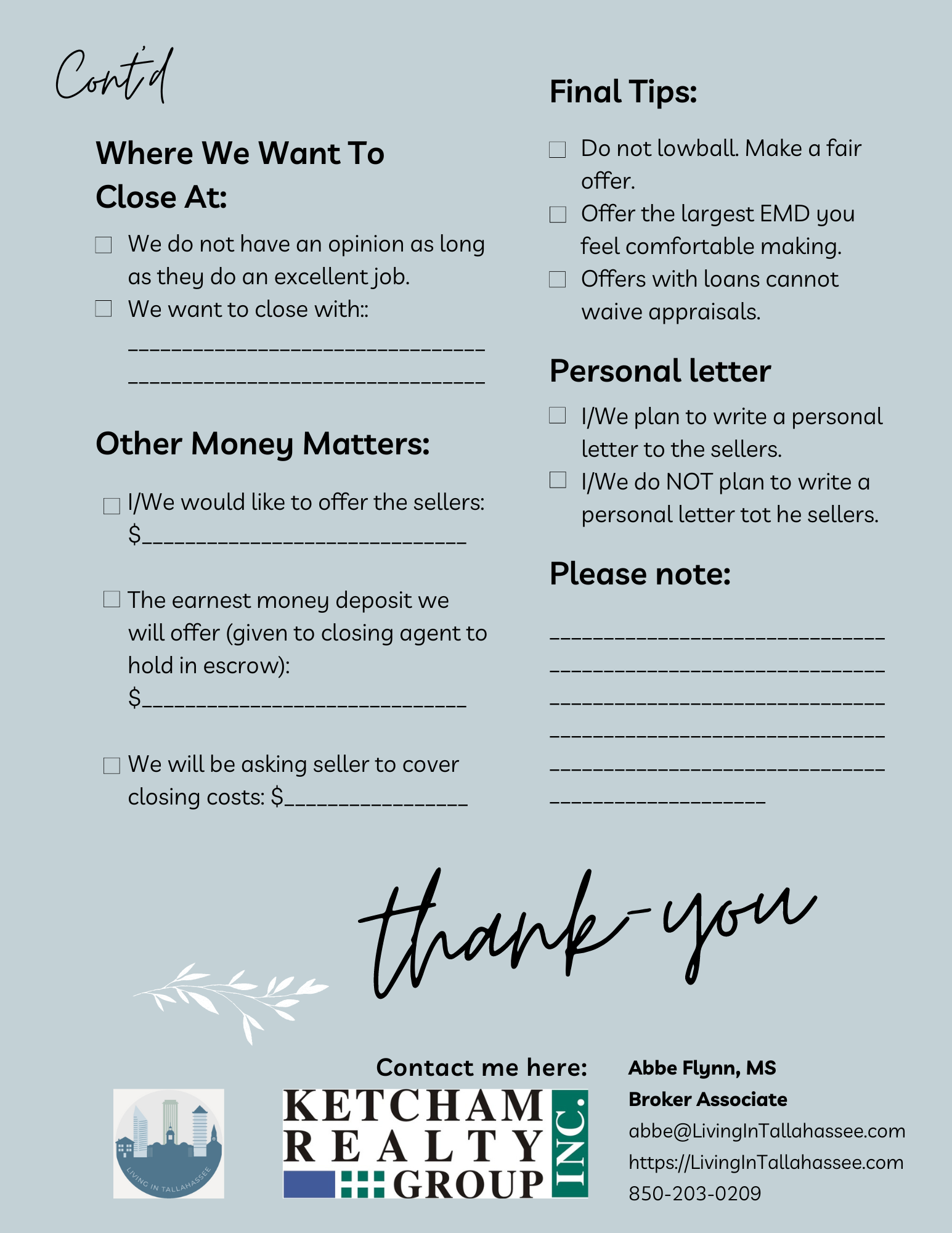

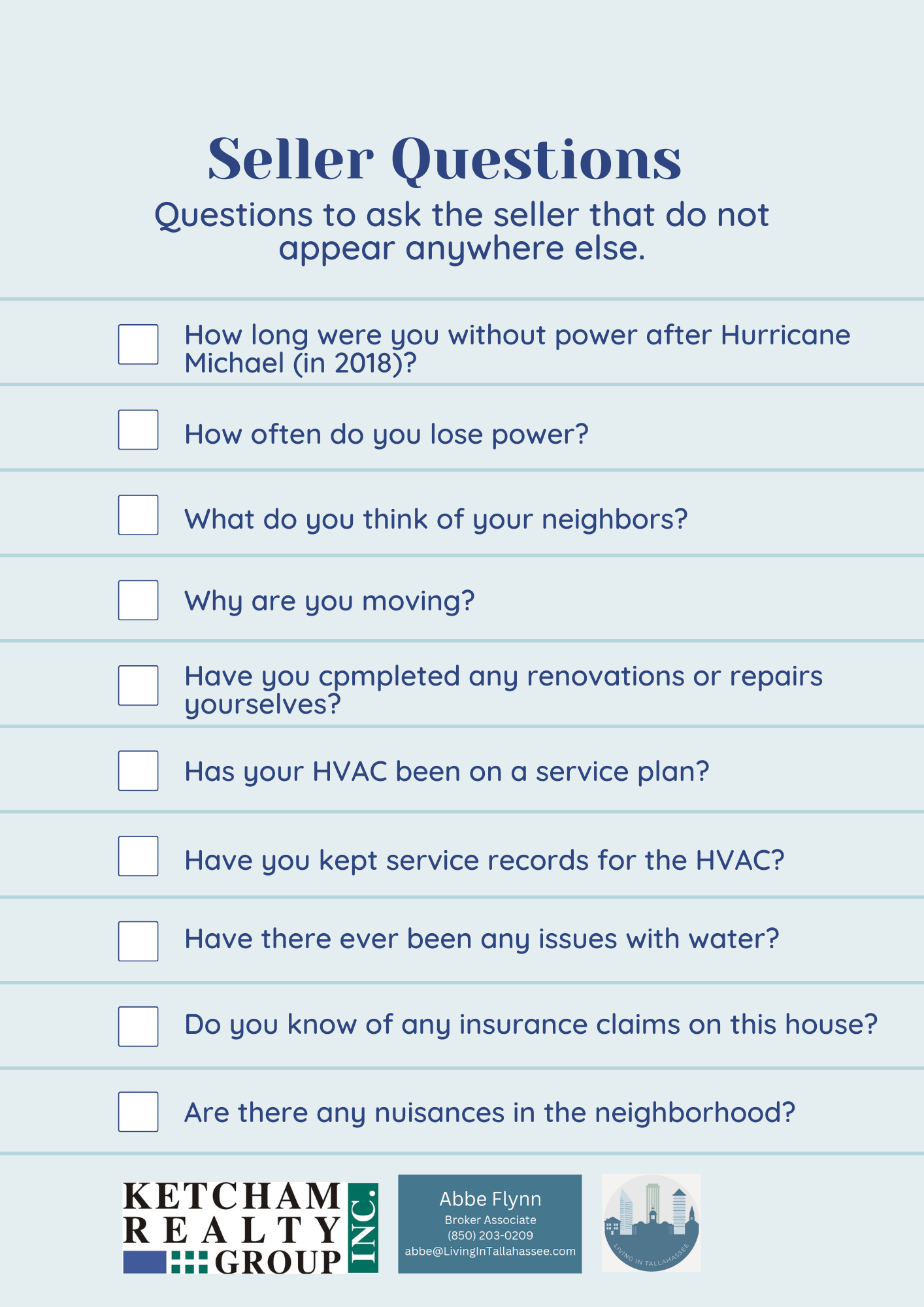

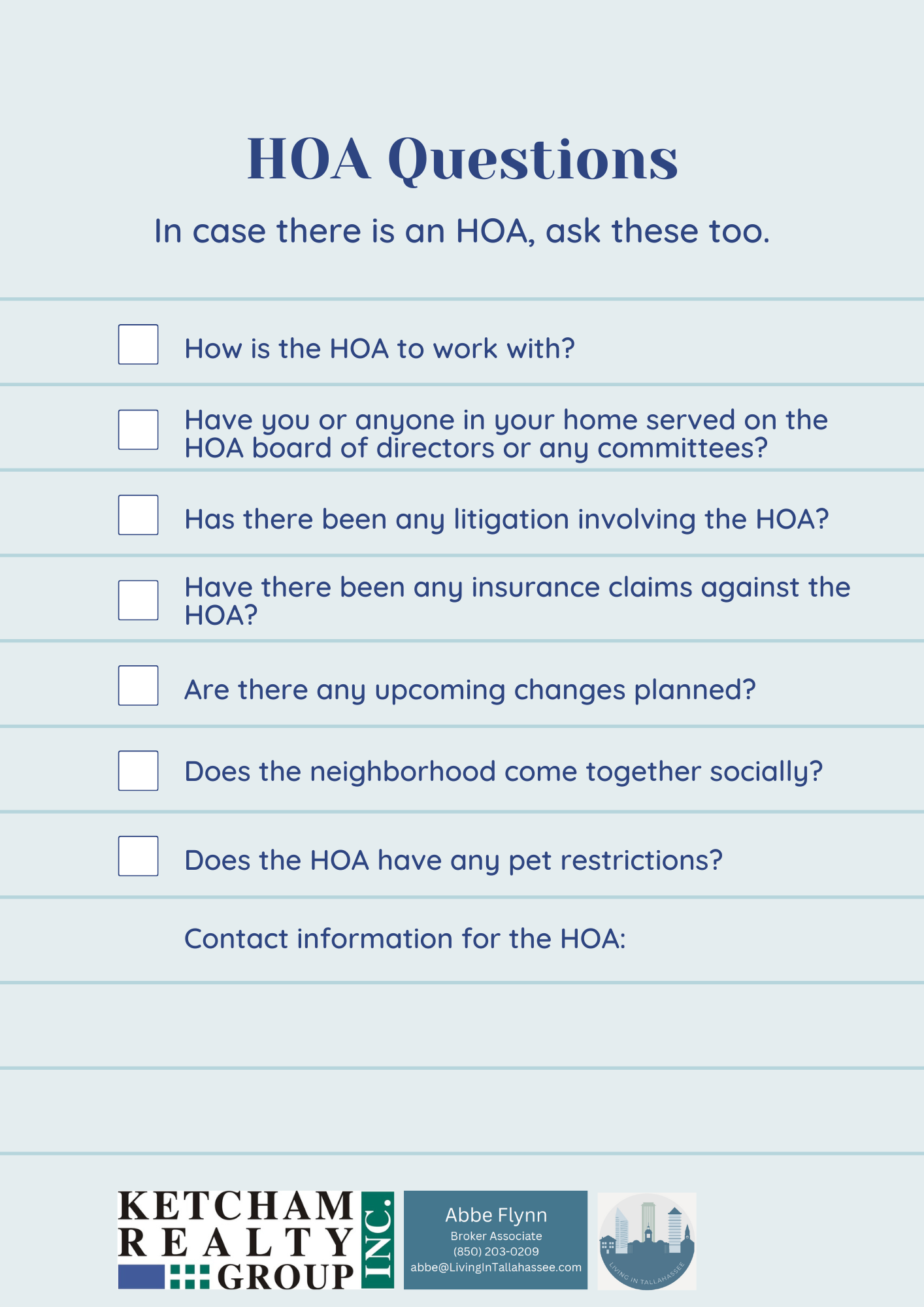

Download checklists as PDFs:

Hire an experienced Tallahassee Realtor to represent you during home buyer negotiations.

Experience matters. When it comes to anything important, we want to know the person whose advice and actions we rely on can be trusted – right? Hiring the wrong Tallahassee real estate agent can cost you time, money, and heartache. Buyer’s agents make a difference in home negotiations. There are lots of ways to meet agents, including open houses. We meet MANY buyers that way ourselves. Research done by the National Association of Realtors tells us that the first Realtor most people talk to – is the only one they talk to and the one they hire. No judgment. We did that when we bought our home too. Fortunately, we stumbled across experienced Realtors.

We have talked to Tallahassee home buyers who intend to negotiate directly with the seller’s agent. They feel that negotiating directly with the seller’s agent is the best way to ‘cut a deal’ with the seller and get the best advantage in negotiations. Does that make sense, though? The agent knows the seller better than they know the buyer who just approached them. Even as transaction brokers, it is easy to feel more allegiance to the sellers you have gotten to know. Even transaction brokers have limited confidentiality agreements.

Just like most professions, doing something over and over does teach us. Practice makes perfect so they say – right? Sometimes we learn the hard way, by doing things wrong or missing something. Do not be a part of the inexperienced agent’s learning curve unless you have the experience to protect yourself. The inexperienced agent may worry more about their money than yours. If you want peer-reviewed journal articles to support this statement, you are our kind of people. We have a bibliography – contact us!

What to expect from a Buyer’s agent:

Quality agents will ask you many questions about yourself before scheduling to see the first house. Check out some of the questionnaires we have used below. We use these forms to get a feel for what will make you happy in a new home. Agents should ask if you are working with another agent or if you have picked a local lender. The agent will expect you to be pre-approved before you start looking at homes. Most Tallahassee Realtors have their favorite lenders. You can find ours on the loan application checklist.

Get pre-approved with a LOCAL lender – it helps home buyers negotiate.

Sellers want to know that the offer they sign will get them to the closing table. Their listing agent will help them decide which offer is the strongest and most likely to get them what they want. The pre-approval letter means that a lender has looked at your assets, your income, and your debt and feels comfortable committing in writing that you would qualify for a home loan.

The prequalification letter does not provide the seller (or their agent) with the same confidence level. It is worth the time it will take you to get that preapproval letter. You will have to submit the paperwork eventually if you intend to purchase the house. From experience, we have learned that getting this set up sooner is better than seeing homes you love but do not qualify to purchase. Having a local lender helps tremendously with home buyer negotiations.

What to expect from a lender:

The lenders will take your application and tell you what you will qualify for after running the numbers. For pre-approval, they will ask for a lot of information and documentation of your debt and income. Download our mortgage checklist. We want to stress using an experienced LOCAL lender. A few areas with quirks can sneak up on the inexperienced lender or a lender ‘not from around here.’ That has cost Tallahassee home buyers money they did not have to pay.

There is also a level of comfort for sellers when they know the loan officer, or at least the lending institution as a local. I have been on both sides where having that local lender made a difference in whose offer the seller chose.

Do set your priorities down in writing.

If you have been dreaming about coffee on the deck, the family holiday meals you will host, the solitude of a man cave, or something else, it is time to write it down. Putting down your priorities in writing will help you avoid buyer’s remorse. Before we bought a house together, I thought I knew my husband. Turns out, we didn’t have the same priorities in our new home. Our poor Realtor spent a long time showing us homes before we finally found something that appealed to the both of us. That is why I have so many checklists about preferences and wish lists for homes.

Look through the checklists we have posted on this page. If you plan to buy a home with someone else, this is an excellent time to discuss your expectations. Set down your five must-haves and five want-to-haves in writing and compare them. It will help you sort out which home will best meet your needs. It is easy to fall for a pretty face (or beautiful home). You could end up with a home that looks gorgeous but only has one of your must-have priorities. This leads to buyer’s remorse, and that stinks.

Please check the settings on your social media accounts before you begin home buying negotiations.

Buyers and sellers are often curious enough about each other to do a Facebook and/or google search to see what they can find. Make sure there is nothing posted that will compromise your negotiations. We had a seller that was asked to help cover the buyer’s closing costs and pointed to the buyer’s recent vacation photos posted from Europe as the reason he did not feel the need to help with the buyer’s costs. Fair enough.

Some buyers will take this as an opportunity to ‘sell’ themselves as buyers. They post pictures that tell a story about their home search. Highlighting their awesomeness, they post adorable pictures of their families and pets. Just remember that these pictures may turn sellers off as well, and not everyone wants their private lives on social media.

Things To Know to Prepare for Home Buyer Negotiations

Understand your Tallahassee real estate agent’s role.

As we mentioned above, it is essential to have your own representation through the home negotiating process. Often buyers will sign up for home searches through websites. Home buyers receive numerous notifications as new homes are listed, and blog articles are posted. These websites sell your information to Realtors. Buyers often feel a sense of loyalty to those agents because they were the first to reach out, send links to homes, or provide informative emails. To be clear, you do not need to feel loyal to the highest bidder. Also, you can fire your Realtor anytime.

When negotiating your home, you need an agent who will communicate with you in a way that makes you comfortable. Buying a home is a big decision, and there are lots of things that impact the outcome. An experienced agent will help you understand your options and the pros and cons of each decision. Buying a home is also an emotional experience. You want an agent who remains calm and kind even when the news is bad. You can (and should) fire the agent that disappears, pressures you, or does not listen to your concerns.

Representation agreements explain an agent’s role and often ask for duties and responsibilities from the buyer. If you want the agent to keep something confidential – here is where you put it. If you want to see what is on there before you sign (AND we highly recommend that), email us, and we will send you a copy. The form is used throughout the state.

Home buyers should know their numbers for multiple negotiation scenarios.

Compared to last year, Tallahassee buyers are looking at a less competitive market. As a result, sellers spend more time marketing their homes before finding a buyer. Comparatively, more of them are leaving the market without finding that buyer. In addition, based on conversations with other Tallahassee Realtors, we see more sellers agreeing to pay for repairs and closing costs, sometimes both now.

What happens if you find that ugly home in the perfect neighborhood with an attractive list price? Depending on the condition, it may not qualify for financing. Fortunately, loan products out there let you borrow money to renovate that ugly place BEFORE you move in. These renovation loans have EVEN MORE moving parts than the average sale. Ensure your agent is experienced with these loans before negotiations. These loans require detailed paperwork, cost slightly more, and take longer to close. Before loan approval, you will need to know how much the renovations will cost.

It is tempting to increase your bid when your agent tells you that there are multiple offers on the home. Even in our cooled-off market, we see multiple offers on gorgeous and well-priced homes. Decide how high you can comfortably go before the heat of negotiations. You will be tempted to increase that number, and please do so carefully. We have been house rich and cash poor before, and we thought the pool would make up for family vacations.

Sellers may listen to you while you see the house. Do not compromise your negotiations.

As a buyer’s agent, we worked with a couple moving to Tallahassee from Miami. In Waverly Hills, they found a house that met many of their needs but had a tremendous amount of deferred maintenance. The buyers discussed how a top listing price should mean a superior listing condition. They pointed several of these items out to me as we went through the house. The banister was loose. The flooring was worn and needed to be replaced. The counters were dated. The appliances were old. The house also had a tremendous amount of neglected wood rot. When touring, we noticed Alexa was playing music in multiple rooms.

As we worked our way through the house one last time, I received a text from the listing agent. “Sellers will address wood rot in a suitable offer, but not countertops, appliances, or flooring.” Alexa had been sending our conversation to the sellers. Even though we had discussed the possibility of sellers listening to our discussions during home tours, it was easy to forget. In this case, the buyers were not interested in making an offer on the home. If they had been, they would have compromised their negotiation leverage by discussing how high they would be willing to go versus what they would offer.

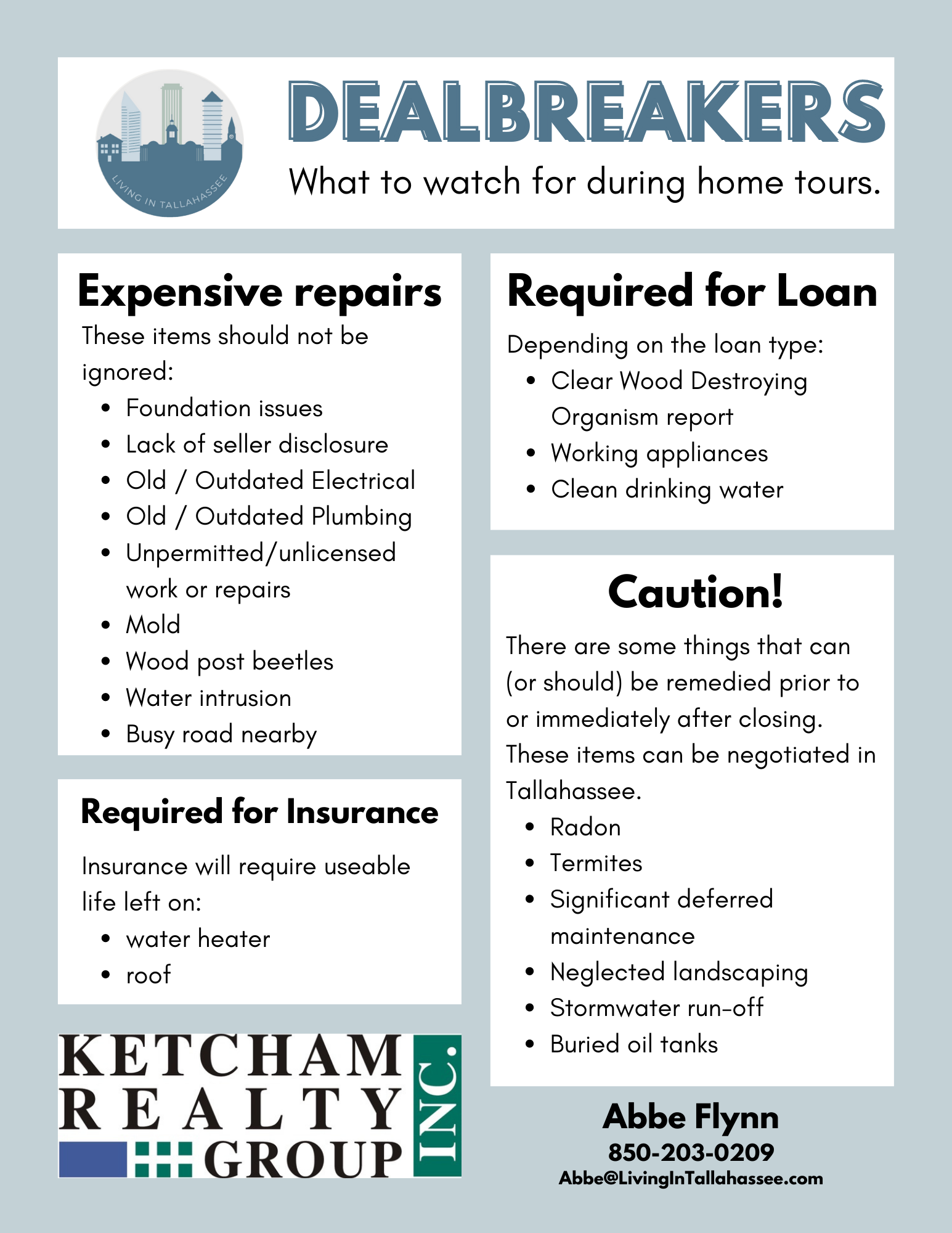

Watch for deal breakers and pay less attention to cosmetic items.

There is no perfect home, and each home is imperfect in a unique way. While sellers are not required to complete a disclosure form, they must disclose all material defects that affect the home’s value. After you are under contract, you will hire inspectors to verify or inform what flaws the house contains. Throughout the home buyer negotiations, remember that the buyer can walk away for any reason within the first two weeks.

Do not give up on a home for cosmetic or minor issues. Paint is quick and easy to fix, and minor repairs for the chosen school zone may be worth it in the long run. If the inspector recommends a specialist for a second opinion, we recommend taking the time and money to investigate further. If you are concerned about running out of your contingency period, you can request that the seller extend inspections to cover that item. The seller can refuse.

Ultimately, the contingency period gives the buyer time and access to the home to decide if the house’s flaws are livable. This is the only time the buyer will be able to spend significant time inside the home. Get the insurance quotes early in the contingency period. That way, you will know whether the insurance company will require a new water heater, roof, or something else. If the seller does not pay for the needed repairs, the buyer will be required to do so. Takes those costs into consideration.

Things To Decide Before Home Buyer Negotiations

Decide to negotiate for your home in Good Faith.

Usually, buyers know the market better than sellers. It is buyers that set the market, after all, not sellers. Before making the offer, look at all the active and sold homes comparable to the one you are looking at. The best way to determine a fair price is to look at the recent sales and adjust the offer price based on desirable features. You should also check the condition and amount of deferred maintenance on those sold homes.

Look for any sale in the same subdivision within the previous six months. Do not use the price per square foot. It is not a valuable tool for deciding what to offer. Look at the houses that sold closely. Do they match in size, number of bedrooms and bathrooms, garages, fireplaces, pools, age of the roof, water heater, and HVAC, updated bathrooms or cabinets, etc.? The more similar, the more they can be relied on to indicate the value of the house you are interested in making an offer on. Finally, have your agent look at any nearby expired or withdrawn listings. What homes did not sell also tells a story. Those listings tell you what other buyers rejected.

Lowballing can lose you the home you want.

We recently worked with a family purchasing a home for their daughter to attend Florida State University. The home they liked was listed at the top of the market at $265,o00. There were four recent sales in the subdivision: the highest at $260,000. This had been my listing, and I knew it had trouble appraising at that price. The only reason it did was that the whole house was new, down to the studs. The appraiser could appraise it at new construction prices only because of the extensive permitted repairs and renovations.

The home this couple liked was not in the same (new) condition. The guest bathroom contained a new vanity too large for the space. The kitchen’s backsplash was peeling away from the wall. The counters and bathtub had been painted before they were cleaned. Only some flooring had been replaced. Worse than any of this, though, was the old roof. The damaged roof allowed water to run down the wall and into the subflooring.

The buyers offered $245,000 for this house. I did not feel this was a lowball offer. It felt high, considering the condition. The seller was furious. They would not even send us a counteroffer. When pressed, the listing agent said she countered at $290,000. The buyers considered this house the one, so they sent a new offer for $260,000 and asked her to replace the roof and any associated rotting wood. By the way, this is the offer the seller had interrupted our showing to tell us she would be willing to do (roof – not the rotted wood). She countered this new offer with $290,000 and no new roof or other repairs. The buyers found something else. The seller removed the home from the market and rented it out.

Decide not to squabble with the seller before you are under contract.

It was common in that crazy seller’s market for sellers to price high considering the condition of their property. There were more buyers than homes, and it seemed like every home on the market found a buyer. It often felt like there was not a price too high for buyers to pay in some of the Killearn neighborhoods. That lead to buyers making offers on homes that had significant unknown questions about their conditions. This summer we saw many homes go under contract only to come back to the market after inspections. When the market started to shift from a sellers’ market to a buyers’ market this summer, home negotiations changed. Buyers were not as willing to purchase homes in substandard conditions. Meanwhile, sellers were still not willing to make repairs.

If small questions are hanging over the home you have chosen, do not argue with the seller over repairs or code violations. On the other hand, big unanswered questions, and indications of neglected maintenance, are warning signs of a potential money pit. If the seller has refused to address big-ticket items or price the home with the repair in mind, they may be unable to cover the cost. They may be unreasonable about their home’s value as well. No matter what the issues (or nonappearance of issues) are, once you are under contract get an inspection. Based on those reports, decide if there is a deal breaker.

Do not waive contingencies without discussion and consideration.

Some buyers remove financing or inspection contingencies from the contract to entice the seller to choose their offer. We do not recommend that. Contingencies are there to protect the buyer in most circumstances. Waiving those contingencies should be carefully considered before being put in writing. The one most waived is the financing contingency. If you trust your lender to close on the loan based on what you have provided them, waiving the financing contingency makes more sense. You can also ask your lender to shorten the time they need to close on a home loan. Most mortgages can close in 30 days or less. Some buyers have even been tempted to waive the appraisal contingency. Discuss this with your lender before you do.

Home Buyer Negotiations – Additional Tips

Download checklists as PDFs:

Please, for the love of negotiations, READ THE CONTRACT!!!!

The contract contains promises you make to the seller. You are bound to follow through when you sign your name on the offer contract. Please read this document before you sign it. If you have a friend or family member that is an attorney, have them explain the terms to you. Make sure you are clear on what you are committing to when you sign. In Tallahassee, we have two main contracts we see most often. One is the Tallahassee Board of Realtors Contract for Sale and Purchase. This was copyrighted and vetted by Tallahassee’s Board of Realtors’ attorneys.

The other is the FAR-BAR ‘as-is’ contract copyrighted and vetted by the Florida Association of Realtor’s attorneys. Even with an as-is contract, you can still ask for repairs – IF you find something unexpected or undisclosed during inspections. Do not sign the as-is contract expecting the seller to renegotiate repairs later. They will feel you have not acted in good faith. Sellers are not obligated to complete ANY repairs unless they agree to the repairs in writing. Most attorneys we have worked with as customers prefer the FAR BAR contract. However, some Realtors in Tallahassee refuse to submit seller offers when presented on this contract. (Which is against the law, our ethics agreement, and is just plain stupid.)

Find out why the seller is selling. Find out what the seller wants (besides money).

If the seller is downsizing but staying local, giving them more time to move might help win you the contract. If sellers do not have a place to land next, offering a lease-back can sweeten the offer, or an extended closing date. Sometimes savvy listing agents will not provide this information when requested. Most agents are looking for a win-win and can give you some clues on what the seller wants to see.

The answer is always no if you do not ask.

Keeping in mind the caution not to low-ball and tick the seller’s off, sometimes sellers are just testing the market and will consider a crazy offer. In the end, when working with us, we do what you ask us to do. We will offer advice and suggestions if you ask, but this will be your home and we will ask for whatever will make your heart happy. We have done this long enough to know you cannot predict people’s actions, so it is better to ask and be told no than to wonder if you could have gotten that deal you wanted.

Do not be afraid to walk away.

Sometimes sellers are unreasonable and you just have to walk away. Some folks have to learn things the hard way. We hope you have already discussed the deal breakers before you have even started viewing homes. If you feel the seller is not being reasonable, or the price is not worth the value, walk away. There will be other homes come to the market.

Inspections can change everything.

Repairs can be negotiated even with AS-IS contracts. If you have an inspection and it reveals previously undisclosed damage or deferred maintenance that will require a significant amount to correct, then buyers can and should share this information with the seller. While the seller is rarely required to perform any maintenance or repairs, if they were unaware of the problem, they will likely want to negotiate it. Even if the seller refuses to complete any repairs, they may be willing to provide a concession to cover the cost of the repairs. Some repairs may be required for homeowner’s insurance and therefore required by the lender before closing. Even if required by the lender and the seller will not complete the repair, some lenders will allow a repair holdback at closing. This is especially common with roofs in Tallahassee. Some homeowners’ insurance want at least 7 years left on a roof. They will send their own inspectors to check. In the case of a repair holdback, the title agent will hold the money for the roof from the seller’s proceeds. Once the permit is closed and the buyer is satisfied, the contractor is paid by the title agent.

Get all agreements in writing.

We once had a buyer we were working with make an offer on a home in the northeast side of Tallahassee. In the sellers’ disclosures, seller had written that she was replacing the windows in the living room. The house sat on the market for a while, and the seller changed her mind about the windows and instead opted to remove the bright green plush flooring for about the same price as the new windows. When the buyer made an offer, she signed the sellers’ disclosures that stated the seller would replace the windows. Since the replacement of the windows was not on the offer contract, the seller had forgotten what she put and was blindsided by the invoice the buyer sent for her to pay for the new windows they picked out. If your offer is contingent on the sellers making the repair or update, put it in the offer. Sellers should be very careful about making promises for any repairs that have not been negotiated with contractors yet. Once under contract, any receipts for repairs are shared and all repairs must be performed by appropriately licensed contractors.

Next Steps!

Thanks for reading all the way to the end! We want to help you with home buyer negotiations. If you are ready to begin the home-buying process, contact us!

You can find more information on our other Tallahassee home buyers pages. There we talk about how to finance your new home, what to expect when touring a home, and pitfalls to avoid when buying your Tallahassee home. If you have a question we have not addressed, drop us a line at: [email protected]

We look forward to hearing from you!