When buyers receive their lender letter and approval, they are eager to see homes for sale. We know we were!! Let’s talk about what to look for when touring Tallahassee homes. One of home buyers’ biggest regrets is not asking enough questions or missing something big. Our biggest goal is to help you avoid missing anything big too.

STORYTIME:

MJ and her husband found the perfect house for their growing family after many months of searching. She wanted a specific neighborhood, and that neighborhood did not have many sales. This house was a cheap flip, and there were visible issues. The contractor had not pulled permits for any of his work because he was the ‘owner.’ Worse, he had done the visible stuff but not the necessary stuff. The air conditioning died as we were touring the home and the roof had an active leak. When the inspector informed me there was a corner of the attic and in the garage that was not visible. I was concerned.

In the decade I have been negotiating homes, only twice have I recommended that a buyer terminate a contract and run. This was one of those times. There were many little signs that the contractor was not diligent. So many things that showed us what kind of person he was. By the way, this is also how we found out that there are absolutely no repercussions from Tallahassee, or Leon County, for not pulling permits appropriately.

Lesson Learned

It really stinks when buyers spend money on a home that you will not sleep in. However, it is so much worse to sleep in a house that will drain your wallet dry in repairs and maintenance. Here’s the thing, problems leave evidence. Over the years of showing homes, we have snapped photos of that evidence. So, with that in mind, let us discuss some things you should look for during home tours.

When working with buyers, we want to reduce the likelihood of buyer’s remorse the best we can. However, that does not mean we will not show you whatever you ask. Buyers often buy something they were not sure they liked at first. All stories aside, we have found some things that help buyers feel like they have negotiated a ‘good deal.’ And who doesn’t want a good deal? When you are ready, we trust you will contact us!

Note about the actual tour of Tallahassee homes for sale…

Your Realtor will set up the home tours for you. They must coordinate with your schedule, their schedule, and the seller’s schedule. Sometimes there are specific rules about how and when we can show homes to potential buyers. Once the route is set, and the seller has given permission, your Realtor will send you the route and times. Some buyers will ride in the agent’s car. This is helpful for out-of-town buyers who want to see the neighborhoods we drive through. Most of the time, buyers will follow their agents in their cars. Whichever works.

For more information about buying a home in Tallahassee check out these pages:

The Eight Step Process Overview of How to Buy a Tallahassee Home

What You Should Know About Financing Your Tallahassee Home.

Here’s what You Should Know About Negotiations Before You Make An Offer

What Inspections You Should Consider Purchasing

Follow this link to download a copy of our Tallahassee home buying book!

Deal Breakers – What to Look for While Touring Tallahassee Homes For Sale!

Let’s review some signs that indicate an expensive repair. These may be structural or features that require a significant investment of time and/or money to maintain or repair. If the house you LOVE has one of these items, there are tough negotiations in your future. If the seller does not repair these things before you close, you will need to do them soon after for your own safety or to protect your investment.

Foundation issues

Sometimes you can look at a home and tell it is not straight. Sometimes potential or imminent structural failure is entirely hidden.

STORYTIME: This summer, we sold a home to a young woman who wanted to live in Forest Heights area. We found a brick home that appeared to be solid and had a newer roof and air conditioning system. During the inspection period, we had several inspectors crawl all over this place. We attempt to coordinate inspectors to arrive simultaneously and overlap their inspections.

As I walked across the concrete patio, the sound my heels made changed. It went from a dull ‘thunk-thunk-thunk’ to a higher-pitched sound with an echo. This caused the inspectors’ heads to turn in my direction. After tapping around the patio, they found a large cavity underneath. Upon closer inspection of the brick nearby, they found the tell-tail signs of foundation issues – the stairstep crack. It was barely visible. The home’s roof had been dumping water on a patio crack for years. Because of this, the ground underneath the patio had washed away and left a large void. Bet you can guess that was an expensive estimate.

What to look for when touring Tallahassee homes:

Foundation failures usually show up as a stairstep crack in the wall. For this house, the most obvious evidence was in the sound the patio made when tapped. The crack in the bricks was visible once it was searched for, but it was not apparent during the home tour. In this case, look for a sound change when walking across floors. Patios sitting on the ground will make a low ‘thunk’ sound when tapped. The void will sound hollow when tapped.

Not all cracks are signs of an expensive repair. The house in the above story had a crack across the driveways and sidewalks, in addition to the patio. The patio crack was not the warning sign, though. In this case, it was the sound that was the first clue. Most cracks are not a big deal. It seems like every concrete patio, driveway, and sidewalk is cracked in Tallahassee. Keeping concrete perfect between the pines and the stormwater runoff is impossible. When in doubt- ask a specialist to look.

Outdated Wiring.

When touring Tallahassee area homes, we have found “knob and tube” wiring in some of the Antebellum homes. This is copper wiring run through ceramic knobs – without anything covering the wires. It is dangerous, but it is not something we see very often. Old electric panels and poor electrical work are much more common in Tallahassee. Sometimes it can be hard to tell if the lightbulbs are burned out or if something is wired incorrectly.

The electrical panel is one of the things that the insurance company wants to see a picture of before they insure homes. The insurance agent may ask for a four-point inspection if your home is older. This report will include a photo of the electrical panel without the cover. Sellers should replace all light bulbs and clear the space in front of the panel for the inspector’s safety.

Signs of electrical issues to look for when touring Tallahassee homes

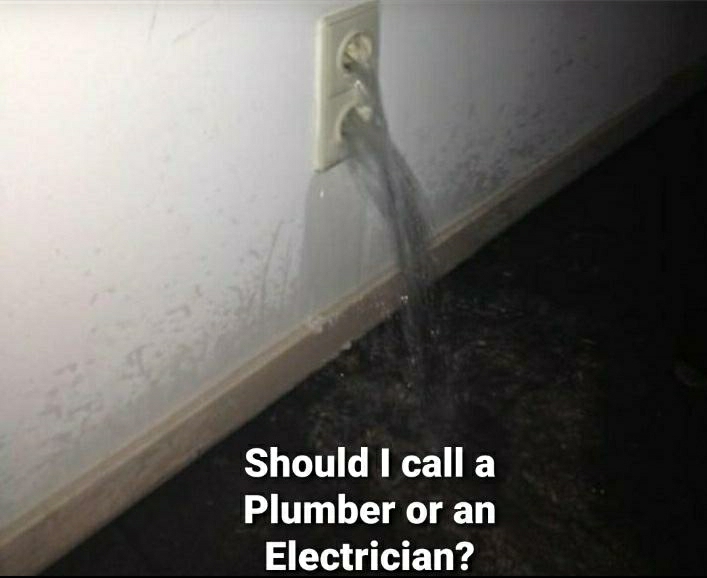

Anytime you turn on a light and get a shock or see a flickering light, that is a warning sign of faulty wiring. Also, look for burn marks around the outlet or outlet covers that look yellow and brittle. There is sometimes a buzzing sound for poorly wired homes, though old fluorescent lights also buzz. Extension cords running in all directions can also be a warning sign, especially if they are warm to the touch. Look for signs of circuit breakers being frequently tripped.

One of the things the inspector will look for is where electricity is near water. These two things together are very dangerous. Sometimes things will look unusual to the inspector, and they may not be able to recognize whether it is safe or to code or not. They will recommend that you have a specialist look. Many electricians charge only a small fee to diagnose a potential problem. Having peace of mind is worth paying for their time and expertise.

Plumbing – including polybutylene piping

From 1978 until 1995, many homes were built with polybutylene pipes. Polybutylene is a type of plastic that was cheaper and easier to use than copper pipes. Their use was widespread in the sunbelt and the Tallahassee area.

The problem they found was that the oxidants in the water supply reacted with the plastic inside the pipes. This caused internal scaling and flaking, which lead to stress fractures. The stress fractures in the pipes were challenging to see and not immediately recognized for the danger they posed. After 10-15 years of use, the pipes would fail, often catastrophically. This caused extensive and expensive damage inside many homes. If polybutylene plumbing is found, it is recommended that it be replaced by a licensed professional. Most of the time, these pipes have been replaced in Tallahassee homes with CPVC (chlorinated polyvinyl chloride), which is still the preferred piping.

What to look for when touring Tallahassee homes

Polybutylene piping was usually grey in color (could be black or blue) and flexible. It was usually 1/2″ to an inch in diameter with copper-colored fittings. Often the pipes were stamped with “PB2110” on the side. Most of the bad piping has been removed from Tallahassee homes.

We see leaking toilets and faucets more often. While touring the home, listen for the sounds of running or dripping water. You will also hear toilet bowls filling up without being flushed. Step around the toilets and sinks to feel for soft subflooring. Look under the sinks and water heater for signs of water damage. Also, places that smell damp often are. Use all five senses when touring Tallahassee homes. Water run-off from storms is covered below.

Mold and mildew in our humid environment

Touring Tallahassee homes without finding mildew somewhere would be rare. In our humid climate, mildew is very common. If there is insufficient circulation from your air conditioning system, you will see mildew grow on your shoes in Tallahassee’s closet. We have worked with many buyers who say they know when the house has mold. Their sinuses swell up, and they leave the house after only a few minutes with a headache and dripping nose. Most people are not so sensitive (thankfully).

Just because it looks like mold does not mean it is dangerous. It is a sign that something must be addressed. Not even specialists can look at the stain and determine if it is a dangerous kind. Get it tested. Not all inspectors can test for this, it does require additional certification. Let us know if this is important to you, and we can help you find a specialist to get it tested during your inspection period.

Insurance Required Repairs – Roof and water heater.

Tallahassee home buyers have faced stiff competition with other buyers, and sellers have not voluntarily given repairs or other concessions. The fall of 2022 has seen a shift in the market with fewer buyers. Fewer buyers also means that some sellers are leaving the market without finding a ready and willing buyer for their home. Fewer buyers has also meant that buyers can negotiate concessions that sellers would not have granted before.

Buyers routinely negotiated the insurance and lender-required items even during the most robust seller’s market. Insurance companies often require new water heaters and newer roofs constructed with modern techniques. The insurance industry has taken a beating in Florida, and even as we are still cleaning up from Hurricane Ian, there are many unknowns about the industry’s future. We have seen insurers and lenders require many things, new roofs and water heaters are the most common.

Roof – life left on the shingles

Because of the insurance unknowns, it is best to get your insurance quote as early in the home-buying process as possible. Sometimes the insurance agent will require an inspection form completed by an inspector. Some of the more prominent companies have inspectors who will do this for you. One of the things they are measuring is the life left on your roof. They also look for modern construction techniques like ridge vents and hurricane clips. Even if there are no active leaks, the insurance company will require at least several years of reasonable life.

Water heater – it doesn’t matter if it works or not – how old is it?

We hear this complaint all the time. “Why do I have to replace it if it is working?” It is not advisable to pick a fight with the insurance provider. You can win the battle and lose the war. Meaning they will not require you to replace the water heater, they just will not insure it until you do. If the buyer is financing the home, it will require insurance. This means many sellers replace the water heater.

Nightmare neighbors – How do you know?

This one is the hardest to test for when buying a Tallahassee home. There also seems to be one problem neighbor in each neighborhood. So, when buying a home, what do you do, and how do you know who you will live near?

Many neighborhoods now have Facebook pages. You can find your neighbor’s names on the property appraiser’s website. If you are a dog person, walk your dog in the neighborhood. We met many people in Linene Woods by walking Bonny the Basset and Clyde the Bloodhound. We also highly recommend knocking on the neighbors’ doors and talking to them. Tallahassee is a small town, you likely know some of the same people. Don’t worry – they are as curious about their potential new neighbors as you are about them. Besides, if they slam the door in your face, doesn’t that tell you a lot too?

Potential deal breakers to watch for when touring Tallahassee homes – depending on further inspections and/or repairs.

These items create uncertainty for future home ownership. Be aware of these things. Something that needs significant maintenance issues can be expensive over time. This list also includes neglected items and things that now need to be repaired. If the seller does not repair them, they will need to be by the buyer soon. Or, in the case of termites and beetles, watched and maintained for years to come.

Oil tanks can be an EPA violation. Watch for buried tanks.

Sometimes owners don’t even know they are in the yard. If your inspector does not walk the perimeter of the house, he may not see the signs of the tank. If the EPA ever finds that the tank is leaking, the owner will be required to clean it up. Most of the buried tanks we found in Tallahassee were filled with sand and left underground in the yard. The fill and vent pipes are usually removed when the tanks are filled, but an astute inspector will still find the signs. These are more common with homes built before the 1980s. Before buying a Tallahassee home that has or had a buried oil tank you should consider having the tank removed, abandoned in place, or tested.

For above-ground tanks, a simple visual inspection of the tank can tell you a lot. Even if the tank is rusted it may still be solid, but the risks increase. Look for signs of leaks such as oil stains on the ground or on the bottom of the tank. For homes with gas appliances, the tank is sometimes stored above ground. These tanks can look rusted and still be solid; however, a clean and freshly painted tank provides a higher comfort level.

Unpermitted and/or unlicensed work – verify after touring Tallahassee homes.

When talking with other agents, it sometimes seems like the 80s and 90s were the wild west when it comes to permitting. During and following the pandemic, many city and county employees retired rather than return to the office. This means an already overworked staff fell further behind in processing building permits. Needless to say, builders grew tired of the delays and excuses. Some vowed to build in Crawfordville, and it shows.

When is a permit required?

General rule – whenever something structural is done to the home or work requires a professional license. Technically, you need a permit for a new ceiling fan AND a water heater since it is over $1000. Yes, it is a cumbersome and lengthy process to get a permit in Tallahassee right now. This does not mean you can just skip it. When buying a home, check the property appraiser’s site for permits. There is a link at the bottom of the page that will open a new window. Also, check that the license matches the work that is being done. We have a story for this one too.

STORYTIME: We sold a home with a roof replaced when it was purchased. This was after the damaging storms of 2014 and 2015 rolled through the Tallahassee area. After those storms came many contractors, including the carpenter, who had replaced the roof. The carpenter was not a roofer. So, the roof failed inspection after only seven years. Even though it was actively leaking and one of the trusses had softened and started to bow, it had not left visible damage inside the home.

Do you need to have a permit if you are the owner doing the work yourself?

Yes. We helped a buyer put a home under contract where the owner had enclosed a screened porch themselves. The roof of this Florida room leaked, and the carpet was moldy. When the owner had put on the Florida room, he had also replaced all the other windows in the house. Unfortunately, he did not seal the windows properly, and the water found its way into the walls of the home. From there, the wood under the window softened and collapsed. The repair was significantly more than the contractor had quoted them for the work originally.

Cracks in the walls and/or ceilings

It might be nothing. There are a lot of homes with cracks that haven’t moved in decades. If the crack is getting wider, or allowing water to run along it, you could have a hidden problem. Have your inspector take a look or hire a foundation expert to investigate.

This is another reason to get and keep a copy of your inspection report. In the following years of ownership, you will have photos of what the house looked like when you purchased it. If that crack starts to grow, it is time to have an expert take a look.

Wood Post Beetles, Termites, and other Wood Destroying Organisms (WDO)

This is the south and removing bugs from living spaces is a constant battle. Some believe the bugs never truly leave, but the pest control people will treat the wood, and the bugs will move along. At least for a while. However, the treatment will wear off and need to be reapplied regularly. The bond treatment costs around $600, and the length is determined by the company and product they used.

If you see evidence of an insect invasion while touring Tallahassee homes, ask the seller to provide evidence of treatment or, better yet, a bond. The bond will cover any damage to the house that wood-destroying insects made after their treatment. If you are using your VA benefits to buy a home, the seller will be required to provide a ‘clean’ WDO report.

An active infestation is one of the few things Tallahassee buyers and Realtors expect sellers to address before selling. This is also true for safety issues and active leaks. Of course, sellers are not required to complete any home repairs. However, some homes will not sell if those items are not repaired. There are loans that allow buyers to complete those repairs after closing. They are more expensive and time-consuming and not always an option.

Radon

While touring Tallahassee homes for sale, we occasionally find evidence of radon mitigation. Radon gas is invisible and odorless and seeps up from the ground through the foundation into the home. Prolonged exposure is deadly. Radon is the second leading cause of lung cancer (after smoking). Testing is the only way to know the level of radon being trapped in the house you are considering. The Environmental Protection Agency has lots of useful information about radon.

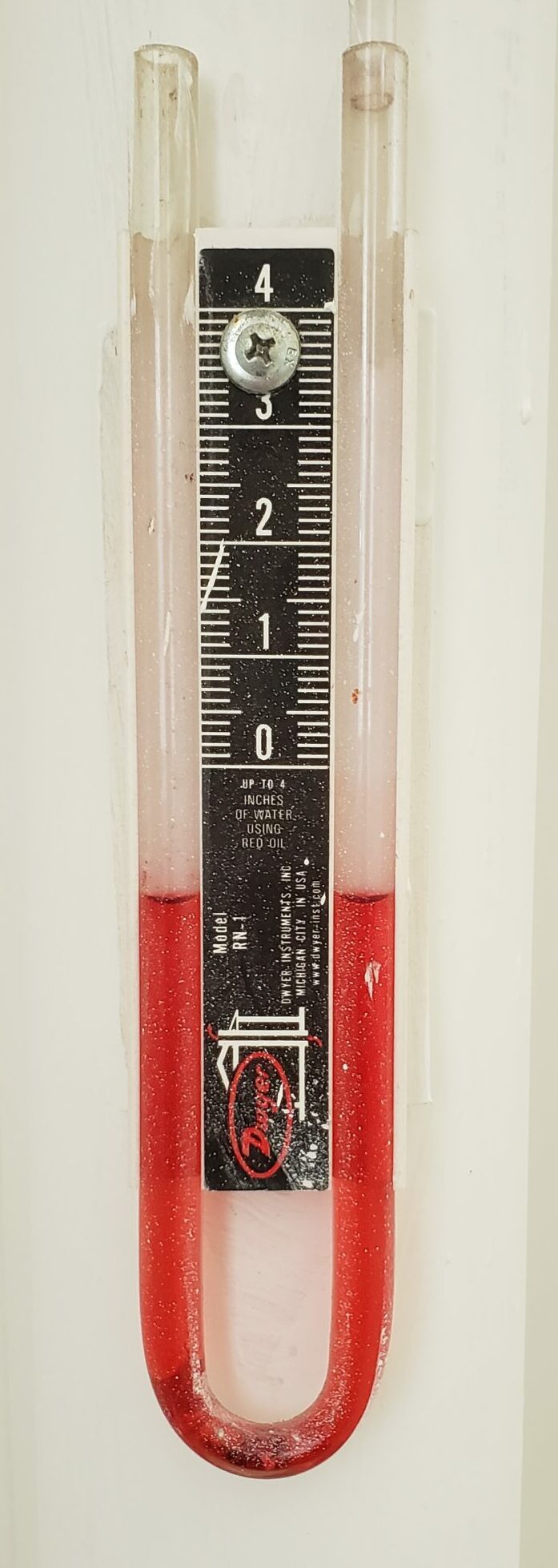

Approximately 25% of the homes tested in Florida have ‘unsafe’ levels of this radioactive gas. If you see a tube with red liquid in it or a 3-4″ tube running from the foundation through the attic, the house likely has a radon mitigation system in place. If the level of the liquid is even, like the photo to the right, the system is not functioning as intended. Get the radon levels tested.

Water intrusion

When touring Tallahassee homes for sale, water intrusion concerns us the most. It can appear in many ways inside a home. Water can flood from a toilet not being appropriately set and sealed. The air conditioning lines often have condensation (like the outside of an iced tea glass), and that water can create stains over time. If the air conditioner’s drain pan overflows, it can cause thousands of dollars of damage. Poor landscaping can also contribute to water intrusion. All water intrusion creates the possibility of dangerous mold growing inside your walls.

Inspectors have a gadget they can use to determine if the leak they see is wet. This is another good reason to have inspections on or just after rainy days. Water run-off will leave evidence in the landscaping. You never want it running along the walls or foundations. Water finds a way to get to someplace we do not want it to be. Fortunately, landscaping is an easy fix for a new homeowner.

Storytime:

The picture to the right has a lot going on in it. This started as an elderly gentleman replacing the roof himself to save several thousand dollars. We never quite got the whole story, but the end result was an injury that never fully healed and a roof that leaked. This wall had water running down it when it rained in the summer. The insulation is black from being damp. When it became evident that the owner was not going to be able to complete the work, they called several ‘contractors’ they found on Google. From several quotes, they chose the handyman without a license.

What is not evident is the gap between the wall and the window (on the other side of the window), the sag in that wall under the windows (evident from the outside), the floating tile, and the soft floor along that whole wall. We guess the water ran down the wall and across the floor joist until it left a small pond underneath the house in the crawlspace. The total repair was fifteen thousand more than the roof replacement a reputable local roofer had quoted them.

What water damage to look for when touring Tallahassee Homes

We sold a home built in the 1940s. The toilet had leaked long enough that the floor to the bathroom felt spongy from the sink to the tub and into the hall and another bathroom. As bad as that was, it was not something that scared us away from that house. The damage was localized to a six-by-six area in the bathrooms. Since the softened wood did not reach any of the structural support walls or other support systems. The damage was fairly easy to repair.

However, the water damage was more extensive for another house in Indian Head about the same age. The landscaping had been dumping water into the crawlspace every summer afternoon for several years. The flooring support beams for the living room, kitchen, and first bedroom were sitting in water and had all gone soft. The floor was dropping away from the walls, and the fireplace was leaning to the left side. That kitchen pass-through window was drooping. The contractor we sent under the house came back out in a hurry. It was not safe. It was going to be an extensive and expensive repair. We passed.

You can rely on the experts to tell you how extensive or expensive the damage could be, but it may be worse since water damage is often hidden. Evaluate these issues on a case-by-case basis. Don’t be afraid to get a second or third opinion. Do not be afraid to walk away either.

More potential deal breakers – depending upon lifestyle and/or comfort with repairs.

These are things to consider and for some, they will be dealbreakers. Everyone has their own lifestyle. Many in Tallahassee have dogs and/or are nature lovers. Many people love to spend time outside. Some people never want to sweat (good luck here in July and August). However you live, make sure your home can accommodate your lifestyle. Here are some things to consider when touring Tallahassee homes for sale.

Is there a busy road nearby?

Do you have pets that are escape artists? Is walking the neighborhood something you like to do? Do you have a soon-to-be driving child in the house? Knowing what traffic passes in front of the house is important to buyers for all these reasons and more. When we were housing hunting, there were homes we would not make an offer on because of where they sat in relation to a highway. There were neighborhoods we ruled out because we would not turn left across a busy road.

We encourage you to spend time in the community you want to call home. Neighbors will change, but the location will not. How is the morning and afternoon commute? If you are a day-sleeper, check out how loud the neighborhood is during the day.

What is under that flooring?

This question will keep buyers up at night. We will never live on carpet flooring again. The carpet collects dirt, dust, DNA, smells, etc. If the floorboards are cupping, there is a moisture problem. This is usually because the crawlspace needs to be vented or a vapor barrier installed. If the floors change throughout the house, this is annoying but an easy fix. You can estimate a cost between $3 and $5 a square foot, depending upon the quality of flooring and padding.

If you do pull-up the carpet during your inspection period, you will be required to repair any damage. This usually costs a couple hundred and an increasingly hard-to-find carpet stretcher.

What is the house’s history?

There are a couple of murder homes in Tallahassee. This is not general knowledge, nor is it expected or required to be disclosed by the seller. If this is important to you, go to the police department (if in the city) or the sheriff’s office (if in the county). Ask for any records associated with the address. This is how we found out a home we were purchasing was the site of a suicide. If that is a deal breaker for you, do not depend on the seller to disclose.

What does it look like at 3:30pm in July?

Is the stormwater runoff going to be a problem? Does it drain away from the house? How does the house address the deluge of water we receive during summer storms? Do the gutters and downspouts place the water far away from the foundation? In defense of Tallahassee, they have spent money and resources to keep homes and cars from flooding. The flooding has gotten much better since the mid-90s. If you pick a house in a flood zone (you can tell by checking these FEMA maps), your homeowners’ insurance will require you to carry flood insurance. That cost can range from a couple hundred to thousands every year.

Some final comments about touring Tallahassee homes for sale.

Some buyers have a higher tolerance for things that need to be updated or repaired than others. Do not be afraid to walk away from a home that will not fit with your lifestyle or needs. Homes that feel like money pits will not feel like home. Let’s talk about some of the issues we see most often and what we have recommended to other buyers.

Are there signs of significant deferred maintenance?

If the air conditioning vents are dirty, the filters have allowed dirt into the HVAC system. This makes it work harder than it should and shortens its usable life. If the HVAC air handler is in the attic, it works harder than it should. Are the baseboards dirty? Do the screws in the power outlets lined up? (Electricians often leave this as a sign a professional touched that outlet last.) Are the door frames solid or dry rotten on the bottom?

Is it a bad or ugly remodel?

We once showed a house with black counters, white cabinets, and alternating white and black tiles. There was a puka shell chandelier over the dining room table, and the walls were eggplant purple. The buyers LOVED it. They did not want to change a thing.

It may be an ugly remodel to you, but the next buyer might love it. Anything for the right price can be corrected. It all depends upon the buyers’ tolerance and resources.

The landscaping has been neglected, and the house lacks curb appeal.

This might be a sign that the sellers are ‘indoors’ type of people or that they travel a lot. It might also signify that the ground has a lot of clay and won’t allow anything to grow. Landscaping is essential here in the monsoon Gulf coast. It helps control the water that is dumped on Tallahassee on any given summer afternoon. Landscaping is the most cost-effective remodel or upgrade. The plants are cheap and easy to install and can easily be completed by the owner.

The seller is sketchy. He does not provide information or provides incorrect information.

We have so many stories of deals falling apart because a lack of trust develops between the seller and the buyer. If the buyer finds out that the seller is trying to hide a defect, they get justifiably angry. There are laws in place to protect the buyer in these cases, but enforcement in the courts is a long and expensive remedy.

In the decade we have been selling homes, we have only twice recommended that the buyer walk away because of the seller. We often say that people quickly tell you who they are and you should believe them.

STORYTIME:

While under contract with a friend buying a home in the Indian Head neighborhood (one of our favorites), the seller did not complete a disclosure form. This is not completely unusual, especially for rental properties. During the inspection, the crawlspace was damp, but not wet. The inspector felt something was off, and that there were signs a bigger water issue was being hidden. Days later, after a significant downpour, we checked the crawlspace again. In addition to a water pump attached to a hose leading out from under the house, we also found a small lake in the crawlspace.

Needless to say, that was a significant breach of trust, and the buyers terminated that contract. That house is still being rented in the Fall of 2022. Yuck.

Please check out our other buyers pages for more information.

Financing your Tallahassee home.

Negotiating your Tallahassee home.

Inspections and contingencies after you negotiate your home.

Pitfalls and horror stories to avoid when buying your Tallahassee home.

Download our free Tallahassee home buying book! How to Buy A Home in Tallahassee by AJ Flynn

We would love to hear from you! Contact us here.